What Is Project Financing.

Project Financing.

website : becticfinance.com

Email : info@becticfinance.com

Sktype : bruce.fung001@outlook.com

Project finance is the long-term financing of infrastructure and industrial projects based upon the projected cash flows of the project rather than the balance sheets of its sponsors.

Project finance refers to the funding of long-term projects, such as public infrastructure or services, industrial projects, and others through a specific financial structure. Finances can consist of a mix of debt and equity. The cash flows from the project enable servicing of the debt and repayment of debt and equity.

If you are planning to start an industrial, infrastructure, or public services project and need funds for the same, Project Financing might be the answer that you are looking for.

The repayment of this loan can be done using the cash flow generated once the project is complete instead of the balance sheets of the sponsors. In case the borrower fails to comply with the terms of the loan, the lender is entitled to take control of the project. Additionally, financial companies can earn better margins if a company avails this scheme while partially shifting the associated project risks. Therefore, this type loan scheme is highly favoured by sponsors, companies, and lenders alike.

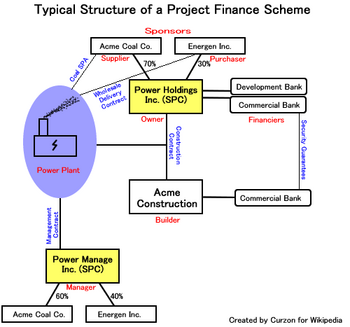

In order to bridge the gap between sponsors and lenders, an intermediary is formed namely Special Purpose Vehicle (SPV). The main role of the SPV is to supervise the fund procurement and management to ensure that the project assets do not succumb to the aftereffects of project failure. Before a lender decides to finance a project, it is also important that all the risks that might affect the project are identified and allocated to avoid any future complication.

Parties to a project financing.

There are several parties in a project financing depending on the type and the scale of a project. The most usual parties to a project financing are;

- Sponsor (typically also an Equity Investor)

- Lenders (including senior lenders and/or mezzanine)

- Off-taker(s)

- Contractor and equipment supplier

- Operator

- Advisors

- Technical Advisors

- Legal Advisors

- Equity Investors

- Regulatory Agencies

- Multilateral Agencies / Export Credit Agencies

12, Insurance Providers - Hedge providers

The Sponsors Of Project Financing.

Usually, a project financing structure involves a number of equity investors, known as 'sponsors', and a 'syndicate' of banks or other lending institutions that provide loans to the operation. … The financing is typically secured by all of the project assets, including the revenue-producing contracts.

- Industrial sponsors – these are the industrialist who see some kind of connection of the project with their core business.

- Public sponsors – These include central or local government, municipalities, or municipalized companies.

- Contractors / Sponsors –These include individuals who develop, build or run plants.

- Financial investors.

(a) Project Company –This entity is created solely for the purpose of execution of the project. They are controlled by the project sponsors. They form the center of the project because of its contractual arrangements with operators, contractors, suppliers and customers.

(b) Contractor – The contractor is responsible for constructing the project to the technical specifications outlined in the contract with the project company.

(c) Operator – They are responsible for the maintaining the quality of the projects assets> the operator can be a multinational, a local company or a joint venture depending on the technology required to run the project.

(d) Supplier – They are the input provider for the project.

(e) Customer – They are the party who are willing to purchase the projects output.

(f) Commercial banks – They source the fund required for project financing. For arranging these large loans banks often form syndicates to sell down their assets.

(g) Special Purpose Vehicle (SPV) It is a separate legal entity floated by the sponsors of the project. The project finance obtained is directed exclusively only towards this SPV. The SPV acts as a corporate veil between the lenders and the parent company preventing seepage of credit and attachment of property between the two parties.

website : becticfinance.com

Email : info@becticfinance.com

Sktype : bruce.fung001@outlook.com

website : becticfinance.com

Email : info@becticfinance.com

Sktype : bruce.fung001@outlook.com

Key Features of Project Financing.

Since a project deals with huge amount funds, it is important that you learn about this structured financial scheme. Below mentioned are the key features of Project Financing:

1, Capital Intensive Financing Scheme: Project Financing is ideal for ventures requiring huge amount of equity and debt, and is usually implemented in developing countries as it leads to economic growth of the country. Being more expensive than corporate loans, this financing scheme drives costs higher while reducing liquidity. Additionally, the projects under this plan commonly carry Emerging Market Risk and Political Risk. To insure the project against these risks, the project also has to pay expensive premiums.

2, Risk Allocation: Under this financial plan, some of the risks associated with the project is shifted towards the lender. Therefore, sponsors prefer to avail this financing scheme since it helps them mitigate some of the risk. On the other hand, lenders can receive better credit margin with Project Financing.

3, Multiple Participants Applicable: As Project Financing often concerns a large-scale project, it is possible to allocate numerous parties in the project to take care of its various aspects. This helps in the seamless operation of the entire process.

4, Asset Ownership is Decided at the Completion of Project: The Special Purpose Vehicle is responsible to overview the proceedings of the project while monitoring the assets related to the project. Once the project is completed, the project ownership goes to the concerned entity as determined by the terms of the loan.

5, Zero or Limited Recourse Financing Solution: Since the borrower does not have ownership of the project until its completion, the lenders do not have to waste time or resources evaluating the assets and credibility of the borrower. Instead, the lender can focus on the feasibility of the project. The financial services company can opt for limited recourse from the sponsors if it deduces that the project might not be able to generate enough cash flow to repay the loan after completion.

6, Loan Repayment With Project Cash Flow: According to the terms of the loan in Project Financing, the excess cash flow received by the project should be used to pay off the outstanding debt received by the borrower. As the debt is gradually paid off, this will reduce the risk exposure of financial services company.

7, Better Tax Treatment: If Project Financing is implemented, the project and/or the sponsors can receive the benefit of better tax treatment. Therefore, this structured financing solution is preferred by sponsors to receive funds for long-term projects.

8, Sponsor Credit Has No Impact on Project: While this long-term financing plan maximises the leverage of a project, it also ensures that the credit standings of the sponsor has no negative impact on the project. Due to this reason, the credit risk of the project is often better than the credit standings of the sponsor.

Advantages of Project Finance.

Effective Debt Allocation.

Project finance enables the sponsors to raise debt over and above the capacity of the parent. This borrowing can be viewed in an individual capacity and is not impacted by the credit reputation of its sponsors. Therefore, more beneficial and flexible terms of credit can be negotiated depending solely on the merit and potential of the project under review.

Conclusion

In project financing, the lenders have limited recourse. This means that in the case of a default, the lenders have recourse to the assets under the project, securing completion and using performance guarantees under the project.

The project financing is contrary to recourse financing, where the lenders get a full claim to the owner’s assets or cash flows. Hence, project financing requires sound financial and relevant technical knowledge.

At BECTIC FINANCE COMPANY LIMITED we offers project financing services for projects of all types in all industries

Please contact us here :

BECTIC FINANCE COMPANY LIMITED

website : becticfinance.com

Email : info@becticfinance.com

Comments

Post a Comment